WhatsApp Pay is now available for iPhone and Android users in India, bringing a new level of excitement to the Indian digital payments market. If you don’t have the latest version of WhatsApp on your phone, you won’t be able to use WhatsApp Pay. More than 160 Indian banks will implement the unified Payments Interface (UPI), which will be used by WhatsApp Pay. The official launch of WhatsApp Pay, which has been available to some users for an extended trial period, has finally arrived. When it comes to competing with Google Pay, PhonePe, and the like, WhatsApp Pay goes head-to-head.

Now that WhatsApp Pay is available to 20 million Indian users, it will be phased in over time to include additional people. A third-party app can handle no more than 30 percent of all UPI transactions per month because of a limitation put in place by NCPI, the National Payments Corporation of India. In India, WhatsApp has a user base of around 400 million people.

What Is Whatsapp Pay?

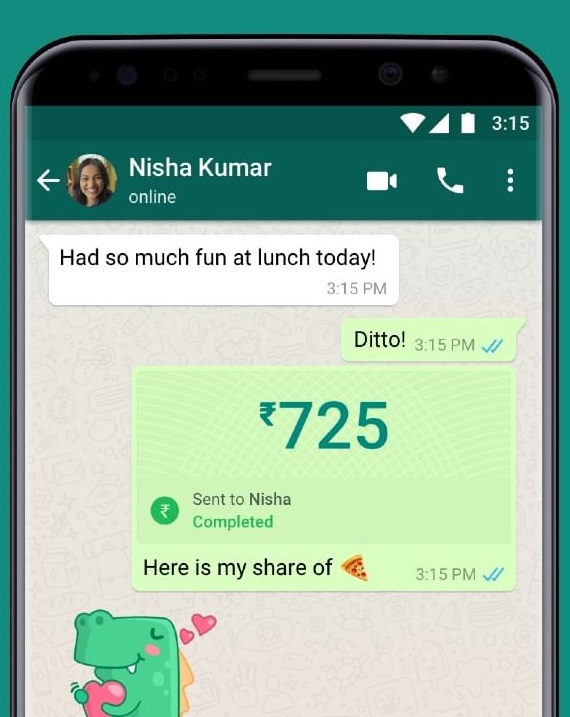

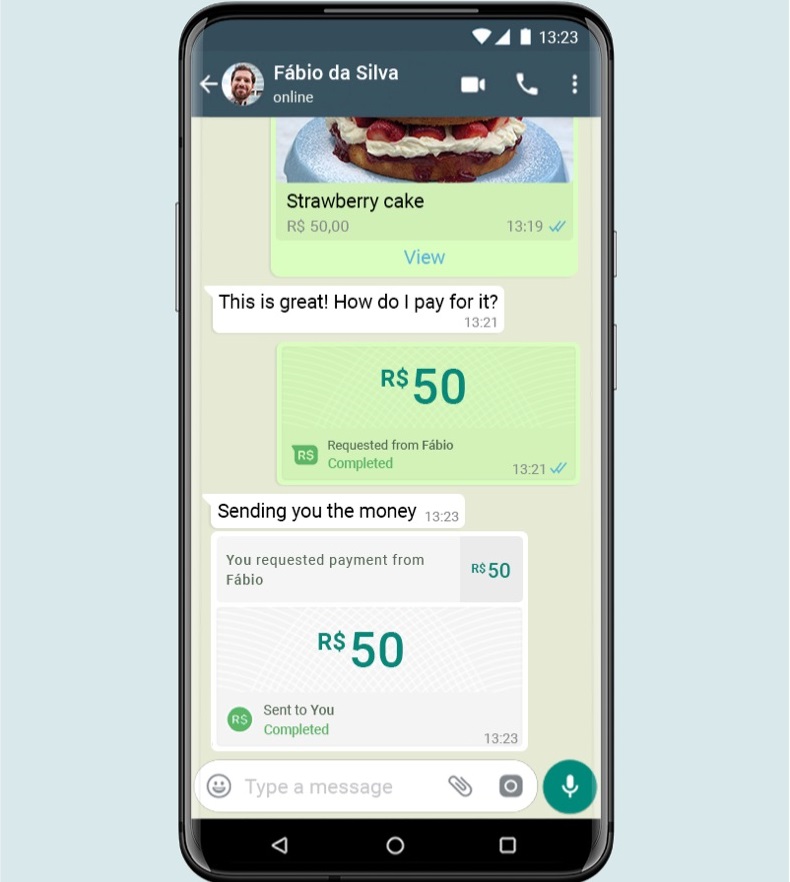

To keep in touch with friends, family, and colleagues, you must have been using WhatsApp frequently. The same Facebook-owned messaging app now has the capability to accept digital payments. It’s called WhatsApp Pay. Using UPI, you may link it to your bank account and start making payments.

How To Set Up An Account For WhatsApp Pay?

- The first step is to launch WhatsApp on your Android device and click on the three dots that show on the upper right-hand side of the app. On an iOS device, go to the ‘Settings’ menu in the lower right corner.

- Select ‘Payments’ from the drop-down menu. You may add a payment method by clicking on the ‘Add Payment Method’ option. You’ll be prompted to agree to the WhatsApp Payments terms and conditions when you sign up. ‘Accept and Continue’ can be clicked on to continue.

- You’ll be given a list of financial institutions from which to make payments. If you have two accounts with the same bank, choose the one you wish to use to make the payment.

- To avoid confusion, make sure the WhatsApp cell number you choose is the same one associated with your savings account. This is due to the fact that an SMS will be sent to this phone number to verify it.

In order to make future payments, you must create a UPI PIN after the verification process is complete.

Also Read: Sandes App: Is Sandes Better Than WhatsApp? [Detailed Comparison]

How To Send Money Via WhatsApp?

1. Simply choose the person from your WhatsApp contact list to whom you want to transfer money and click on their name. Navigate to the payment page using the chat window. Using a person’s UPI ID from a different platform, such as Google Pay, PhonePe, etc., you can send money to the person you’ve selected. A pop-up message will inform you that the contact is not utilizing WhatsApp payments and you can then select the ‘Send UPI ID’ option from the drop-down menu.

Scan QR Code is another method of transferring funds.

2. Enter the money and your UPI PIN in the second step. The money will be transferred to the recipient’s bank account once the correct PIN is supplied.

Also Read: WhatsApp Has Come Up With Unique Keyboard Shortcuts, Check Out All Here!! | The RC Online

How To Receive Money via WhatsApp?

As long as the sender has WhatsApp Pay, you can simply follow the instructions above to transfer money from the sender’s account into yours.

The recipient can still receive money even if the sender does not have WhatsApp Pay. Your WhatsApp Pay UPI ID must be provided to the sender before the payment can be processed. In order to transfer money to you, the recipient will need to enter your WhatsApp Pay UPI ID into the payment platform of their choice. The money you’ve received will be communicated to you via WhatsApp Pay.